My name’s Esther Porte, I’m a Senior Product Manager at MyFitnessPal. I started in marketing analytics at Postmates and then moved into product when I joined Uber, where I stayed for four years. I went from product marketing to Growth Product Manager during that time and then during the pandemic, I joined MyFitnessPal, which is the calorie meal tracking app.

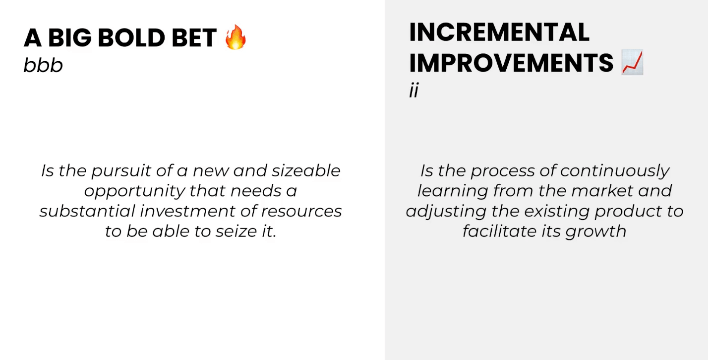

In this article, I’ll talk about big bold bets (BBB) vs incremental improvements (II). I’ll walk you through my definitions of those notions, their limits and much more.

Here’s our main talking points:

Let’s go ahead and dive in 👇

Definitions

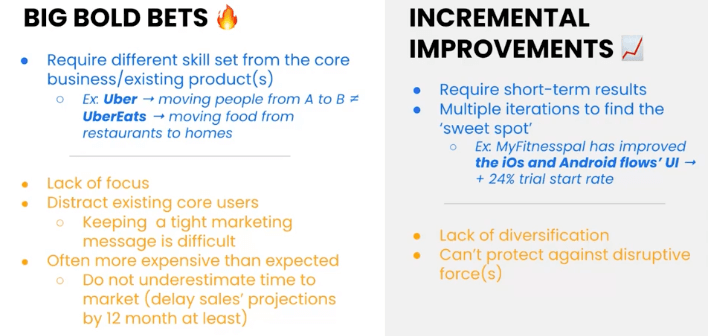

A big bold bet is around risk and opportunity, it’s unproven but it could become a game-changer. Incremental improvement is around speed and efficiency, it's something you can do quickly and that will optimize or iterate on your product and existing product.

Typically, I feel like incremental improvement is something I've experienced more throughout my career. Not everyone has to go into a big bold bet but how can you know to say yay or nay on that idea. Both ideas are different ways to grow your company but the way to get there will differ.

Why pursue big bold bets?

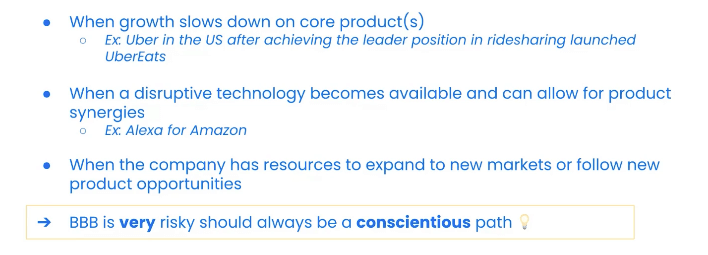

Different situations can trigger the need to invest in BBB…

Different situations can trigger the need to invest in a big bold bet but above are the three I've experienced.

When growth slows down on one of your core product(s)

Let’s take the example of Uber. They started with a core product that was ‘get a ride’ which then became ‘ride sharing’. They started with the US and once they had achieved the leader position in ride-sharing, they thought about what other verticals to incorporate to still gain some growth in that market.

This is how UberEats got started to keep growing non solely focusing on the core product only. That’s one idea that can trigger the need to invest in BBB.

When a disruptive technology becomes available and can allow for product synergies

One of the challenges in this one is to not lose your focus. Let’s take the example of Alexa for Amazon. Obviously, Amazon’s core product is the delivery of goods but when voice recognition became a thing they focused on hardware as well used to improve voice recognition to launch Alexa.

The technology is straightforward, you can order on Amazon through Alexa. That's another example of when you can still find the strategy for your business but invest in something new that becomes available in the market.

When the company has resources to expand to new markets or follow new product opportunities

Uber started in the US and then quickly expanded to other markets. These are company stages where it would be interesting for you to think about a big bold bet, however, BBB is risky and should always be a conscientious path.

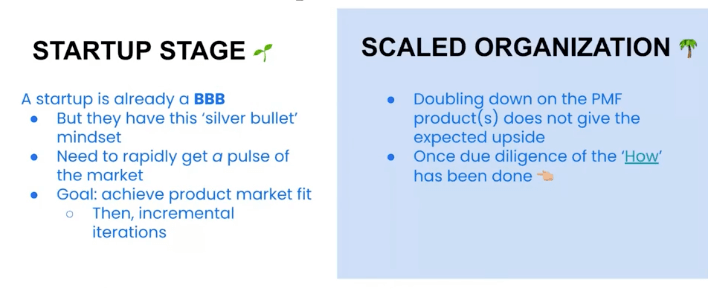

When should you invest in BBB?

There are other company stages but if you are in the startup stage, probably everything you do is already a big bold bet for the next couple of months if not years. You probably have this ‘silver bullet’ mindset where everything you do is brand new because you don't have any historical data and you have to find your product-market fit, which is the one thing startups are looking to find out. Once you get a pulse of the market and your product, then you start iterating incrementally.

If you are in a scaled organization, then you've probably experienced a growth that is slowly slowing down. What you're trying to do at this stage is doubling down on products that are not your product-market fit necessarily because each rating on those has not given you the expected upside you were looking for.

In other words, you have this growth target, you've been iterating on your market fit product but you're just not getting there yet and so you're looking at other potential synergies, technology or markets and this is a big bold bet. Basically, you're trying to find a startup mindset all over again.

How to invest in those bets

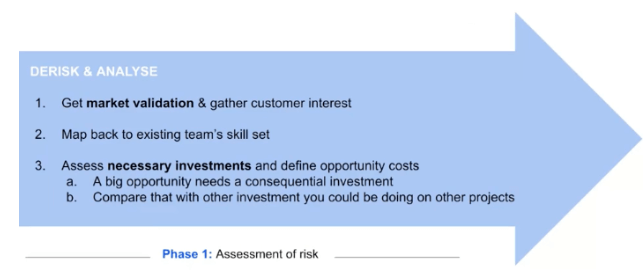

Phase 1: Assessment of risk

The goal in this first phase is to de-risk your decision process by analyzing. The first step is to get market validation and gather customer interest. There are two ways of doing this: through quantitative or qualitative data. Market validation can be done by user surveys or focus groups to get the pulse of the market. I can’t emphasize enough how important it is to talk to users, that’s my advice on getting a pulse.

The other way is by looking at competitors and market data. Looking at how competitors are trending and what they're doing differently that we could incorporate into our app is something you should pay attention to.

The second step is once you've identified this is something your customer would be interested in, map this back to your existing team skill sets. Understand where you have gaps in your organization to achieve these big bold bets.

The third step is looking at your cash flow. Do you have the necessary investments to execute a big bold bet? There are two things you need to look at: looking at the money you have in the bank and working with your CFO on that, but also looking at the opportunity cost while you are working on these big bold bets what are the other projects that you're putting on the back burner and that is something that we'll have to work on with product teams.

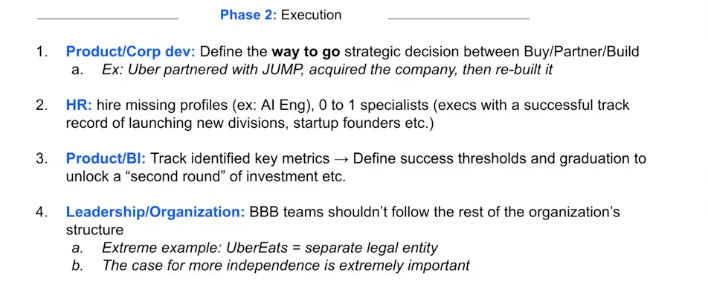

Phase 2: Execution

The execution phase is once all of the different points of the assessment of risk are a yes, how do you execute on those bets.

You have to define the strategic way of investing in this bet: you can buy a company, partner with a company or you can build it in your own right. For instance, Amazon built their own Alexa so they had to hire engineers who were able to build this technology. In the case of Uber, they first partnered with Jump, acquired the company, and then rebuilt the app.

Hire the profiles you are missing, hire execs known to be successful with launching these big bold bets. The offer you're making to them is also very important, there needs to be something that is rewarding the risk they’re taking to join your company and launching something that has never been launched before.

Then you need to identify your key metrics and understand exactly what success means for your company for this BBB. It's like launching a company, you have to have metrics for your seed investments, then once we get there, you need to look at the next step and understand what the metrics are for your series A.

Lastly, ensure the people on your BBB teams can fly on their own. Having a separate department legally from the rest of the company will give your team more independence to achieve quickly.

Limits

Being aware of the limits of these two notions is important because this is an easy process. If you're going to be investing in a BBB make sure you're not lacking focus. Your customers probably know you because of one product or one brand they love and so you still need to be able to keep a tight marketing message.

Typically, a stage companies are aiming at is when they're able to have a couple of successful BBB all linked together by one story. It’s often more expensive than you would expect so make sure you also project your sales which will probably take more time than what you had initially in mind to see a return on investment.

For incremental improvement, there’s a lack of diversification. If you only do incremental improvements, then you may be missing out on a new market change, on the new technology that's coming out, or on newcomers in your industry using breakthrough technology so you have to always be aware. A way to do that may be by working with your core dev team or with your product teams to always look at what's happening outside of your world to make sure you're not missing out on some very important innovations.

‘One’ ideal path

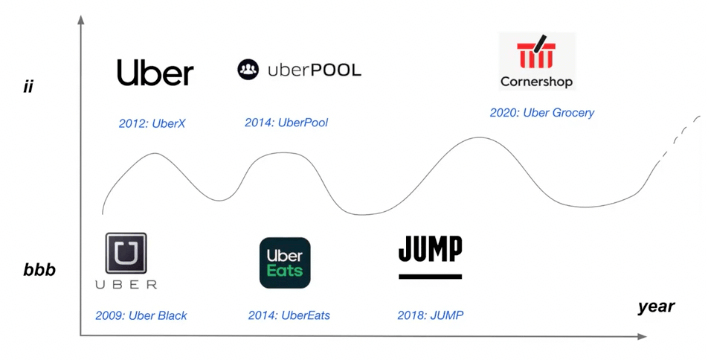

Although each company has its very own way to success, let’s take a closer look at Uber’s path across incremental improvements and BBB.

In 2009, Uber Black was launched which was a premium positioning, you could get a ride at a high price in really nice-looking cars. Then in 2012, they moved to UberX, which was a positioning change, so same product and same technology. That's why I call this an incremental improvement, a move to making those rides a bit more affordable. UberPool is even more affordable when you're sharing a ride with someone and this is still an incremental improvement as well using the same tech.

However, in 2014, growth was slowing down for Uber in the US so they tried a new vertical, which is delivering food from restaurants to your door. That's definitely a big bold bet because the operation needed to do that was quite different.

Jumping a couple of years to 2018, the team I worked on was very involved in acquiring new ways of getting around using scooters and bikes which was also a big bold bet.

Then more recently, with the pandemic starting in 2020, Uber launched UberGrocery with Cornershop and that was delivering not restaurant takeaway but groceries to your door. This is an incremental improvement because it’s not very different from UberEATS. It’s the same idea of moving food around but using an opportunity here of people not going to grocery shops anymore, to expand to new verticals.

To wrap up

Depending on the opportunities that arise around you, you can grab whatever makes sense for you and move to a BBB, incremental improvement or both.

There’s no cyclic path to success but just navigation based on what your company is experiencing throughout the story and throughout the years.