For B2B product managers, especially those focused on driving consistent quarter-over-quarter (QoQ) revenue growth, a clear and actionable go-to-market (GTM) strategy is essential.

This article outlines a practical approach grounded in real-world experience, from scaling products at Series B startups to driving execution within established FAANG-level organizations. It covers the key pillars of market research, cross-functional alignment, execution milestones, and measurable success metrics.

1. Understanding the target market

A strong GTM foundation starts with thorough market research. Focus on three pillars:

a) Objectives and trends

Understanding both macro and micro trends is important for shaping a GTM strategy that resonates with your target customers and stays ahead of the competition.

Staying on top of trends improves both strategic timing and tactical execution. Launching a product or feature just as demand is accelerating can create strong early momentum and help establish market leadership.

Trends also shape customer language and priorities – when your GTM messaging reflects what’s top of mind for buyers, it resonates more deeply and builds trust.

At the same time, monitoring trends helps identify emerging risks – whether regulatory, economic, or technological – allowing you to adjust positioning or roadmap plans proactively.

Finally, a strong understanding of market trends informs longer-term product bets and platform investments, helping ensure the roadmap stays aligned with where the market is headed.

Some key verticals include:

- Agriculture & Food Tech

- Education

- Financial Services

- Government & Public Sector

- Healthcare

- Hospitality & Travel

- Legal & Compliance

- Manufacturing

- Media & Entertainment

- Retail

Practical steps to stay on top of trends

- Set up Google Alerts for key terms in your product domain, target industries, and adjacent technologies.

- Subscribe to industry newsletters and analyst reports:

- Horizontal sources: Gartner, Forrester, IDC, CB Insights.

- Vertical sources: EdSurge (EdTech), Finextra (FinTech), Modern Retail, Healthcare IT News.

- Or PLA's very own Product-Led Post 😉

- Regularly review conference reports and recordings – look beyond keynotes to breakout sessions where practitioners share emerging priorities.

- Gartner Summits (e.g. Gartner Data & Analytics Summit, Gartner Application Innovation & Business Solutions Summit)

- Forrester Events (e.g. Forrester Technology & Innovation Forum)

- AWS re:Invent, Google Cloud Next, Microsoft Ignite (if selling into cloud-first verticals)

- Industry-specific events: HIMSS (Healthcare), Money20/20 (FinTech), SXSW EDU (Education), NRF Big Show (Retail), Manufacturing World, Legalweek

- Add a trends question to customer conversations and QBRs: “What shifts in your industry are affecting your roadmap or buying decisions?”

- Monitor competitor positioning: announcements, product releases, thought leadership, and investor reports can signal where they see the market heading.

- Periodically review government/regulatory updates that may introduce new requirements or incentives in target verticals.

At Freshworks, a public, horizontal SaaS company, we noticed consistent demand across multiple industries. To refine our GTM focus, we systematically tracked trends via analyst reports, customer conversations, and competitive messaging.

This helped us identify industries where digital transformation efforts were accelerating and aligning well with our product’s value proposition. We then prioritized GTM efforts in these verticals, focusing on those most aligned with our north star metric of active product usage growth.

This targeted approach helped us drive stronger early traction and customer expansion in the verticals where we could deliver the most impact.

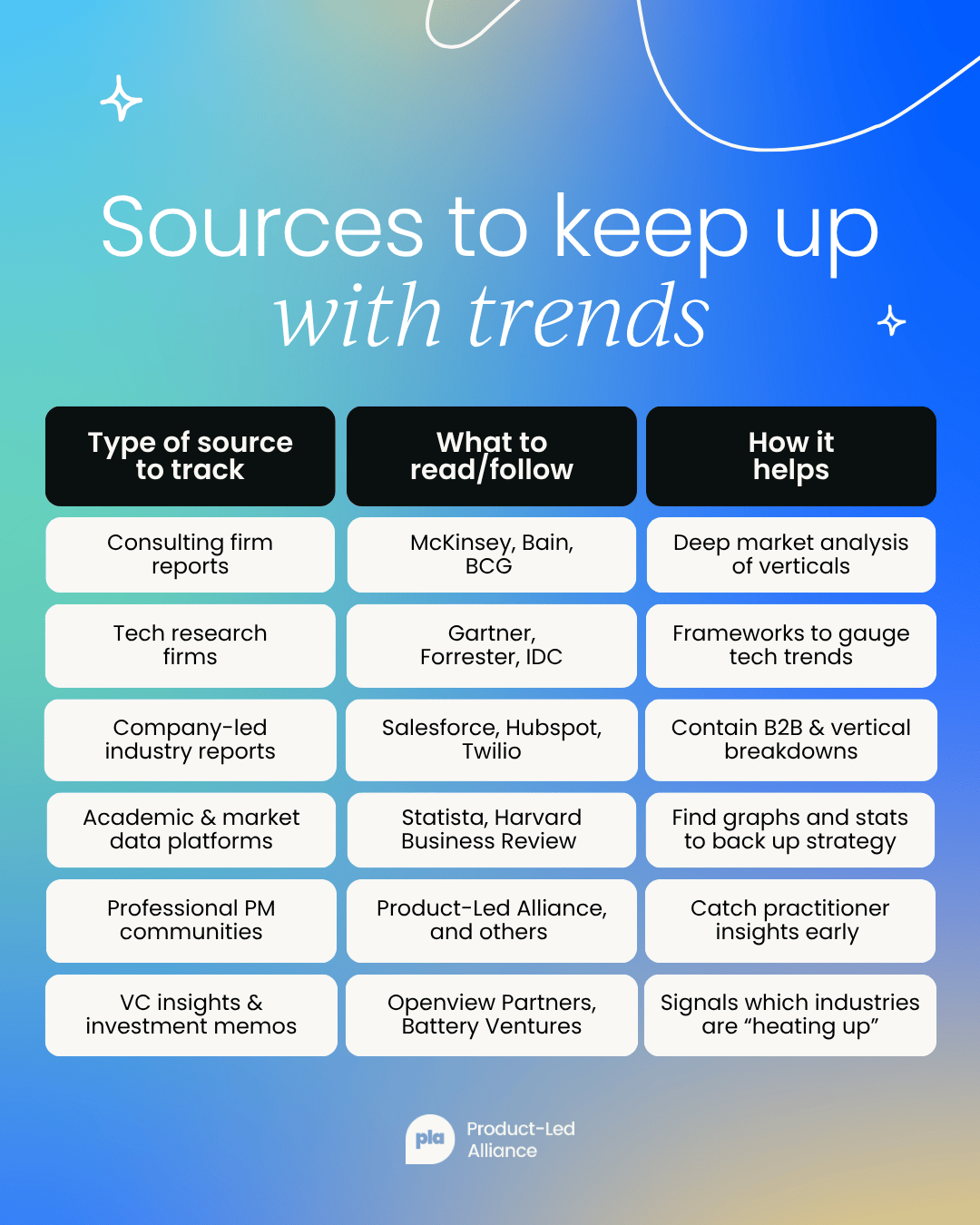

Top sources to track industry and vertical trends (for PMs)

Here are some of the most useful sources I’ve found for tracking trends across industries and verticals. Using a mix of these can give PMs a more complete picture of market shifts and emerging opportunities.

When reviewing industry trends, it’s helpful to map them against typical customer objectives. This makes it easier to identify which trends are actionable and relevant for your GTM strategy.

Common categories of customer objectives include:

- Customer-facing goals: Enhance experience, drive revenue, time-to-market

- Internal efficiency goals: Improve ops, reduce costs, gain visibility, and collaboration

- Risk reduction goals: Compliance, security, ESG

b) Market sizing

Accurately sizing your market helps prioritize early targets and ensures your GTM strategy is grounded in realistic expectations.

Start by combining both top-down and bottom-up estimates. Top-down market size gives you directional understanding (often derived from industry reports), but bottom-up sizing, estimating potential customers × pricing × conversion rates, results in more credible numbers that can inform sales and product decisions.

A useful sanity check is to compare your serviceable obtainable market (SOM) assumptions with the early revenue trajectories of similar companies. If your model shows $5M in bookings within a year, but comparable players took 3 years to hit that number, it’s a sign to revisit your assumptions.

Unlock the secrets to growth and master monetization with our Product Pricing Certified: Masters certification.

By the end of this course, you'll be able to confidently:

- Approach a monetization strategy that works for your company.

- Understand the fundamentals of a product-led motion and the basics of monetization.

- Expertly apply specialized principles that help develop an effective monetization strategy.

- Up-skill yourself to add real value to your product and further drive growth.

Also, look beyond obvious market boundaries. Adjacent markets may represent valuable long-term expansion opportunities. For example, a compliance-focused data platform may initially target financial services, but later expand into healthcare or government sectors where similar compliance needs exist.

Finally, pure sizing misses an important layer: price sensitivity and actual willingness to pay (WTP). Incorporate early pricing interviews or lightweight surveys to understand what potential buyers are truly willing to spend. This prevents building models on theoretical price points that may not translate into actual deals.

At Freshworks, when working on our application tracking system (ATS) product, we initially sized the opportunity using industry reports. But after conducting discovery calls and early pricing interviews with 15 potential customers, we found that WTP in smaller firms was lower than assumed.

This led us to focus our early GTM efforts on mid-market customers along with small customers, where both WTP and urgency to buy were stronger to secure our revenue goal for the first year.

c) Customer personas

Build detailed personas focusing on both business decision-makers and operational users. As product managers, it’s no longer enough to define buyer personas by their job titles alone.

Today’s B2B buyers expect solutions that not only meet functional needs but also drive strategic outcomes like faster decision-making, better cross-functional collaboration, and greater agility in adapting to change.

Understanding the deeper motivations behind each persona – from operational pain points to executive growth mandates, is critical for designing products and go-to-market strategies that truly resonate.

Successful GTM efforts will anchor around these evolving expectations, not static profiles.

Building detailed customer personas is critical for designing products and go-to-market strategies that truly resonate. It’s no longer enough to define buyer personas by job title or company size alone.

Buyers and users expect solutions that support both functional outcomes and broader business goals.

How to find this information:

1) Start with qualitative research

- Conduct discovery interviews with prospective and existing customers.

- Listen to sales and success calls – these reveal both the functional language customers use and their deeper drivers.

- Analyze support tickets and customer feedback to surface pain points and gaps in workflows.

- Engage in industry communities and forums where practitioners openly discuss challenges and emerging needs.

2) Quantitative signals can complement this:

- Use product usage data to segment behaviors by role, team, and company size.

- Analyze CRM and pipeline data to identify common buying roles and objections.

Best practices for building personas

Include not just who they are, but what drives them:

- Primary goals and KPIs

- Key pain points

- Decision-making process and influencers

- Typical buying triggers

- Common objections or adoption barriers

Validate your personas through ongoing feedback – they should evolve with your market.

Align cross-functional teams around these personas, especially product, marketing, and sales.

Freshworks case study

When working on Freshworks’ ATS product, our initial personas focused heavily on recruiters and talent acquisition leaders.

But during deeper discovery, we learned that hiring managers – often overlooked in GTM planning – were critical to driving fast hiring cycles and candidate experience.

Adding hiring managers as a core persona led us to prioritize collaboration features (like candidate feedback loops and interview scheduling), and also adapt our GTM messaging to highlight benefits for this broader audience.

This shift directly improved product adoption and win rates in mid-market deals.

2. Competitive analysis and differentiation

A strong go-to-market strategy requires deeply understanding your competitive landscape and clearly defining where you can stand apart.

Competitor B emphasizes cloud-first, open-source data movement, but struggles with limited data observability and operational maturity, making it less attractive to enterprise buyers.

Competitor C offers analyst-focused, no-configuration replication tools, but its heavy departmental focus limits its ability to scale across the broader enterprise.

Against this backdrop, your product can differentiate by offering superior observability, seamless business process alignment, and scalable operational efficiency – areas increasingly critical to decision-makers who need platforms that not only work but drive measurable outcomes across teams.

To sharpen your positioning further, it's essential to create a market benchmarking exercise: a structured, side-by-side comparison that highlights your strengths relative to the competition on key dimensions like deployment speed, integration depth, scalability, analytics capability, and customer success outcomes.

A strong benchmarking story becomes a foundational asset for both sales enablement and marketing messaging as you enter the market.

3. Building the GTM team and shared goals

Cross-functional collaboration is the engine of effective execution. Your core team should include sales, marketing, product, support, and alliances/partnerships.

Forming GTM/shared goals:

A strong GTM plan requires more than a timeline, it requires tight cross-functional alignment across sales, marketing, product, support, and alliances/partnerships. Setting clear milestones is key, but so is working with these teams in ways that build trust and momentum.

Here’s a typical 30/60/90/100 day plan, with tips on how to collaborate effectively at each stage:

30 Days: Identify early adopters; uncover adoption blockers

- Partner with sales to review the pipeline and prioritize potential early adopters, look for customers who show urgency and a strong value fit.

- Work with support and success teams to capture insights from early users and prospects on likely adoption blockers (technical gaps, onboarding friction, missing enablement).

60 Days: Track win rate and deal size

- Collaborate with sales leadership to co-define what a “qualified opportunity” looks like for the new product/vertical, so that win rate tracking is meaningful.

- Partner with marketing to refine messaging and positioning based on early feedback. This often leads to sharper content and more aligned sales enablement materials.

90 Days: Generate product-qualified leads (PQLs); track trial-to-paid conversions

- Working closely with product and marketing to ensure PQL definitions are clearly documented and understood across teams, misalignment here is a common cause of GTM friction.

- Align with success and support on tracking trial usage patterns and common drop-off points, so product iterations and onboarding flows can be improved in real time.

100 Days and Beyond: Achieve $X million in bookings; reach PMF; secure analyst validation

- Collaborate with sales to set realistic stretch targets by vertical/region, ensuring quotas and compensation models align with GTM goals.

- Partner with marketing and product marketing on building a pipeline of customer reference stories that will support analyst validation efforts (Gartner, Forrester, IDC).

- Work with alliances/partnerships to identify co-marketing or co-selling opportunities that can amplify reach and credibility, especially in new verticals.

Early on, we partnered with sales leadership to identify high-potential accounts and crafted vertical-specific sales plays with marketing. As deals progressed, we worked with product marketing to ensure that referenceable customers were nurtured and prepared for analyst conversations.

By consistently sharing pipeline progress and customer feedback across product, sales, marketing, and success teams, we kept everyone aligned on both revenue and product outcomes.

4. Measuring success

Tracking progress through both leading and lagging indicators ensures alignment with your early revenue goals and supports continuous iteration.

It’s important to understand what each metric is signaling – this helps teams adjust GTM efforts, product roadmap, and cross-functional focus in real time.

Leading indicators

Leading indicators are signals that tell you whether you’re building pipeline and setting up future revenue:

Number of demos/discovery calls completed

- What this shows: Are Sales and Marketing successfully driving interest? Is messaging resonating?

- Healthy benchmark: 2–3x pipeline coverage of target bookings by this stage.

Number of active product-qualified leads (PQLs)

- What this shows: Is your product driving engagement strong enough to qualify leads? Is PQL definition clear and being applied consistently?

- Healthy benchmark: 15–25% of trials converting to PQLs in early stages.

Trial-to-paid conversion rate

- What this shows: Are users finding value during trial? Is onboarding and activation effective?

- Healthy benchmark: 10–30% in early phases, improving over time.

Volume of qualified pipeline, segmented by vertical

- What this shows: Are GTM efforts driving interest in the right verticals? Do pipeline ratios support target revenue goals?

- Healthy benchmark: Pipeline volume aligned to target revenue, ideally with some overage in strategic verticals.

Adoption/usage metrics (for trials or POCs)

- What this shows: Are key features being used? Are POCs showing signs of sticky behavior?

- Healthy benchmark: 70–80% activation of core features during trial/POC phase.

Lagging indicators

Lagging indicators are outcomes that confirm whether GTM and product efforts are converting into sustained business impact:

Customer retention/churn rate

- What this shows: Is your product delivering long-term value? Are onboarding and ongoing engagement working?

- Healthy benchmark: <10% churn annually for mid-market, lower for enterprise segments.

Average deal size

- What this shows: Are you moving upmarket or successfully landing larger accounts?

- Healthy benchmark: Depends on target segment; monitor for positive trend over time.

Win rate across qualified opportunities

- What this shows: Is your positioning and sales execution competitive? Are objection handling and differentiation working?

- Healthy benchmark: 20–35% win rate is typical for early-stage GTM motions; >35% signals strong product-market fit.

Regional booking numbers

- What this shows: Are you achieving geographic spread aligned to GTM priorities? Is sales enablement localized effectively?

- Healthy benchmark: Progress toward geographic targets; early skew toward home market is normal.

Number of customer references secured for analyst submissions

- What this shows: Are you building a credible base of happy customers? Will you be able to fuel analyst and marketing programs?

- Healthy benchmark: At least 3–5 strong reference customers before major analyst engagements.

Customer health scores

- What this shows: Are customers adopting the product fully and seeing value? Are you at risk of churn in key accounts?

- Healthy benchmark: % of customers in "healthy" status improving quarter over quarter.

Continuous measurement and iteration against these indicators help keep the team focused, adapt quickly to market feedback, and accelerate progress toward achieving $X million in bookings.

Conclusion

Launching a B2B product to its first million dollars isn’t about guesswork – it’s about focus, discipline, and execution.

By combining structured market research, sharp competitive differentiation, aligned cross-functional goals, and clear success metrics, product managers can reduce uncertainty and increase their odds of success.

Using this GTM template, B2B PMs can move faster, collaborate better, and lay a stronger foundation for scalable growth beyond the initial milestones.

Follow us on LinkedIn

Follow us on LinkedIn